A Securities Fraud Attorney Can Help

Securities fraud can take many forms. Knowing what to watch for as an individual investor can help mitigate your risk. However, you can never protect yourself entirely, and, as a result, it is important to know what to do if you suffer fraudulent losses as well. Should the worst happen, a securities fraud legal practitioner at Zamansky, LLC is here to help.

We all know that investing is the key to retirement. For many people, investing is also a way to earn passive income—either as a supplement to their regular earnings or as a pathway to financial freedom. But, while there are many benefits to investing wisely, investing also involves risks—and this includes the risk of falling victim to securities fraud.

There are inherent risks to investing in securities. No one can predict the market with absolute certainty, and this means that investing is inherently speculative. But, while certain risks are considered acceptable (subject to an individual’s personal risk tolerance, financial circumstances, and investment strategy), one risk that is never acceptable is the risk of fraud.

Securities fraud is a broad term encompassing the illegal actions of just about anyone in the complex structure that makes up the financial industry. From misselling and misrepresentation to insider trading and a variety of fraudulent investment schemes, plus many more examples besides, there are many potential ways for investors to be caught out and misled.

Fortunately, many finance professionals are fully aware of the regulations surrounding their activities and are committed to acting appropriately. However, whether through negligence or intent, there is also always a chance that their actions not only become illegal but also result in substantial losses for their clients.

If you have suffered investment losses and you believe they resulted not from natural market movements but unethical or illegal practices, you should contact a securities fraud lawyer.

What is Securities Fraud?

Securities fraud can take many different forms, and It is unfortunate that it exists at all, but the widespread and diverse nature of this type of fraud means that individual investors face risks at virtually all stages of investing. For instance, our experienced securities fraud attorneys have successfully handled cases involving entities that committed securities fraud.

- Publicly-Traded Companies – Publicly-traded companies withhold material information from investors, misrepresenting information or delaying the release of unfavorable news.

- Private Companies – Private companies make unregistered securities offerings in violation of federal law.

- Company Owners, Executives and Managers – Company owners, executives, and managers engage in insider trading, misappropriating funds, concealing fraudulent acts, and misrepresenting information to the company’s accountants and lawyers.

- Stockbrokers and Brokerage Firms – Stockbrokers and brokerage firms withhold or misrepresent material information, engage in unauthorized transactions, charge excessive fees, and make trades that do not serve their customers’ best interests.

- Investment Advisors and Advisory Firms – Investment advisors and advisory firms withhold or misrepresent material information, make unsuitable investment recommendations, overconcentrate investors’ portfolios, and engage in various other forms of fraudulent conduct.

- Athletes, Celebrities, Influencers, and Community Members – Individuals not directly involved in the securities market make misrepresentations, omit material information, fail to disclose financial incentives, and use their influence to convince people to make risky investments or invest in fraudulent scams.

- Scam Artists – Scam artists misrepresent themselves as registered brokers or advisors, run “boiler rooms,” fabricate investment products, and use high-pressure tactics to misappropriate investors’ hard-earned funds.

As an individual investor, you trust professionals and securities industry regulators to help keep you safe. Unfortunately, there is only so much these individuals can do, and, in some cases (in fact, in many cases), investment professionals do not have their customers’ best interests in mind. For this reason, no matter how careful they are, individual investors should review their account statements regularly, and they should consult with a securities fraud litigation lawyer if they have any concerns about suspicious activity or seemingly unexplained losses.

FBI: Investors Need to Be On the Lookout for These Forms of Securities Fraud

Several agencies enforce investor protections at the state and federal levels. One of these agencies is the Federal Bureau of Investigation (FBI). The FBI investigates allegations of securities fraud, and it works with the U.S. Department of Justice (DOJ) to prosecute individuals and companies suspected of defrauding individual investors.

The FBI has identified several priorities within the broad securities fraud arena. For example, the FBI is mainly focused on investigating cases involving:

High-Yield Investment Fraud

High-yield investment fraud is characterized by promises of high rates of return with little or no risk.” Despite the inherent volatility of the securities market, some brokers, advisors, and scam artists try to convince investors that they can find “can’t miss” investment opportunities—and they are often successful in doing so. Many investors fall victim to aggressive and high-pressure sales tactics, and they end up making rushed decisions that they would not have made under ordinary circumstances.

Ponzi Schemes and Pyramid Schemes

Ponzi schemes and pyramid schemes involve using investors’ money to pay fraudulent “returns” to previous investors. While these schemes will often appear to be legitimate investment opportunities (and scam artists are becoming increasingly sophisticated), there are still several red flags as well.

Advanced Fee Schemes

Advanced fee schemes are similar to high-yield investment fraud and Ponzi schemes in that they often involve high-pressure sales tactics, but the difference is that investors’ funds are usually deposited directly into the scam artists’ pockets. Investors are typically pressured into making a relatively small investment with the promise of substantial returns, and then they typically never hear from the supposed “broker” again.

Broker Embezzlement

In addition to fraud perpetrated by individuals posing as brokers, securities fraud committed by registered brokers is a genuine concern for individual investors as well. While stockbroker fraud can take many forms, the FBI focuses primarily on cases involving the embezzlement of funds from investors’ brokerage accounts.

Hedge Fund Fraud

Hedge funds pool investors’ money to pursue complex (and often high-risk) investment strategies. While some hedge funds prove to be extremely profitable, the risks involved mean that investing in a hedge fund is unsuitable for most individual investors. Failing to disclose risks, charging excessive fees, and other fraudulent alternative investments often lead to substantial losses for hedge fund investors.

SEC: Investors Need to Be Wary of These Forms of Securities Fraud as Well

The U.S. Securities and Exchange Commission (SEC) is the federal agency with primary responsibility for overseeing the securities market in the United States. It pursues enforcement actions against companies, brokerage firms, and investment advisors as well, and it works as diligently as it can to protect investors from fraud.

The SEC’s website provides a wealth of resources for individual investors. For example, its Guide to Identifying and Avoiding Securities Fraud – published in 2009 but still very relevant today – highlights the risk of financial misconduct, including:

1. Affinity Fraud

Affinity fraud involves individuals using positions of trust and authority to perpetrate securities fraud scams against people who are close to them. It is a particular risk for older investors, who may have long-standing relationships with individuals who choose to perpetrate fraudulent schemes and who may be more susceptible to relying on the information they are provided.

2. Internet Fraud

If Internet fraud was a concern back in 2009, you can imagine how big of a concern it is today. From email scams and fake websites to fraudulent social media endorsements, Internet fraud is among the most significant securities fraud risks for individual investors.

3. Cold Calling and ”Pump and Dump” Schemes

While most people know of cold calling and “pump and dump” schemes from Hollywood movies, these are real scams that result in real losses for real investors. Individual investors need to be extremely wary of any unsolicited investment offers, and they should do their own careful research before investing.

4. Microcap Stock Fraud

Microcap stocks (or “penny stocks”) have always presented challenges for regulators, and today many apps and websites promote these investments as having “low barriers to entry” for people who are interested in dipping their toes into the stock market. However, the microcap market presents a high risk for fraud, and many investors end up suffering substantial losses.

5. Broker and Advisor Fraud

While many brokers and advisors act in their clients’ best interests, some do not. From making unauthorized trades (to generate commissions) to only sharing the information they want their clients to know, brokers and advisors can commit securities fraud in many different ways. These financial experts at local, national and global firms routinely face scrutiny for financial dishonesty, and each year numerous investors are forced to file claims to recover fraudulent investment losses.

How Can A Securities Attorney Prove That an Investor is a Victim of Securities Fraud?

Recovering fraudulent investment losses begins with proving that you are a victim of securities fraud. This requires proof of five key “elements”:

Fraudulent Conduct

Your attorney must be able to prove that a company, firm, fund or individual committed a fraudulent act. This could be anything from withholding material information to conducting unauthorized trades.

Intent

Generally speaking, an inadvertent mistake is not enough to give rise to a claim for fraud, nor is providing sound advice that ends up leading to market losses. In order to establish a claim for securities fraud, it is necessary to prove that the act or omission in question was committed with intent.

Reliance

Even if a company made a material omission or your advisor had a conflict of interest (which resulted in a breach of his or her fiduciary duty), you are not a victim if you did not rely on the omission or advice in question. But, if you did rely, then you may have a claim.

Damages

You must also be able to prove that you suffered damages. These are your fraudulent investment losses; and, while this is generally the easiest element to prove, you must still be able to clearly identify which of your investment losses are the result of the fraud in question.

Causation

Finally, your securities fraud attorney must be able to prove that your reliance on the fraudulent act or omission in question caused your damages. If your losses were the result of ordinary market factors that simply coincided with fraudulent conduct, this alone is not enough to establish a claim for securities fraud.

Why You Need a Securities Fraud Attorney

If you believe that you may be a victim of fraud, what should you do? While you can report the fraud to the FBI or the SEC, it will also be important for you to consult with a securities fraud litigation legal expert. While federal authorities can put a stop to the fraudulent conduct and pursue charges to punish bad actors, to recover your losses, an experienced securities attorney will assist with filing a claim of your own.

In many cases, recovering fraudulent investment losses involves pursuing a claim in FINRA arbitration. The Financial Industry Regulatory Authority (FINRA) is the SEC’s partner in policing the U.S. securities market, and its arbitration forum provides a venue for individual investors to recover fraudulent losses without going to court. Acting quickly can help to improve your chances of recovering your losses.

The Benefits of Speaking to an Experienced Securities Attorney

As noted, it can take months or years for official confirmation that securities fraud has taken place. Bernie Madoff is responsible for making Ponzi schemes widely known outside the securities industry. He was first arrested in December 2008, while questions over the viability of his firm and its actions were first raised in 1999. Even then, the scheme only truly unraveled when Madoff’s sons alerted authorities.

This illustrates the importance of paying attention to your investments, even if you trust the investment advice you receive and the investment advisers that give it. Something as simple as browsing an annual statement over a coffee for signs of inconsistencies and monitoring investment activity for churning can be the difference between a financial recovery and significant financial loss.

If you believe something may not be as it seems, and even if you do not necessarily have solid proof of anything, it is worth consulting a securities fraud attorney.

They can help cast a critical eye over accounts and advise clients of any potential claims. They can also draw on their significant experience. Securities fraud occurs in many different ways, with just some of them outlined above. An experienced lawyer will be aware of industry rules and how they apply to your financial situation and can apply a different perspective to your suspicions.

A securities defense attorney will also have broader insight that may apply to your case. From rumblings on Wall Street to multiple individual investors leveling accusations at the same financial adviser or brokerage firm, robust connections throughout the financial services industry can help protect any investment in a timely manner.

What is the Statute of Limitations?

The statute of limitations for securities fraud claims depends on whether you are seeking to recover your losses in court or through FINRA arbitration. In court, most claims are subject to a limitation period of two years from the date of discovery, subject to a maximum of five years from the date of the fraudulent act or omission. For FINRA arbitration claims, the statute of limitations is six years from the date of the fraudulent act or omission.

Speak To a Securities Fraud Attorney from Zamansky LLC

No matter what form it takes, securities fraud is illegal. As such, a highly-regarded law firm with a reputation for getting clients what they deserve should be your first port of call. If you’re in Florida, we firmly believe that there is no better choice than Zamansky LLC.

With an office in the heart of Miami and another on Wall Street, we combine the personal touch with daily exposure to the latest developments and trends in the financial sector. We back that with decades of combined experience in securities litigation and underpin our commitment to clients by taking the vast majority of cases on a contingency basis.

Whether you suspect foul play or have lost money on an investment for reasons that have already made the news and are ready to take action, we’re standing by to help. Call the Zamansky LLC offices now for a free consultation at 866-502-9313.

How Do I Report Securities Fraud?

There are three primary ways to report securities fraud in the U.S. Whichever option you choose, you will want to act promptly, as this will help increase the chances of the defrauding company, firm or individual being held accountable.

1. Report the Fraud to the SEC

The first option is to report the fraud to the SEC. The SEC is the federal agency that is responsible for overseeing the securities markets in the U.S. and enforcing the nation’s securities laws. It regularly investigates companies, firms and individuals suspected of defrauding investors, and it relies heavily on members of the public to come forward with information it can use to launch investigations.

In order to report securities fraud to the SEC, you must complete and submit the agency’s Tips, Complaints and Referrals (TCR) form. You can either print the form and mail (or fax) it to the SEC or use the agency’s online TCR system.

When reporting to the SEC, “you are not required to furnish any more information than you wish or possess.” However, the SEC recommends that you minimally include the following:

- Your name and contact information (unless you are submitting a tip anonymously);

- The name and contact information of any individual or company you reference in your report;

- A detailed description of the fraud (“including who was involved in the conduct and how, why and when the conduct occurred”); and,

- Copies of any relevant documentation you have in your possession.

If you have information about securities fraud of which the SEC is currently unaware, you may qualify as a whistleblower. Whistleblowers are entitled to certain protections, and they can also receive financial awards if they supply information that leads to successful enforcement action. In order to claim whistleblower status, you must answer “Yes” to the question, “Are you filing this tip under the SEC’s whistleblower program?” on the TCR form, and you must complete the Whistleblower Declaration at the end of the form as well.

2. Reporting Securities Fraud to Another State or Federal Agency

The second option is to report the fraud to another state or federal agency. The Employee Benefits Security Administration (EBSA), state attorney general’s offices, and local police departments all accept reports of securities fraud in appropriate cases. The EBSA handles complaints under the Employee Retirement Income Security Act (ERISA), state attorney general’s offices handle complaints under state securities laws, and local police departments handle certain cases involving embezzlement, theft and other crimes.

When reporting to one of these agencies, it is a good idea to confirm that the agency will accept your report—as each one only handles limited types of cases. You should also make sure that you are providing all of the information required in order for the agency to evaluate your complaint and determine whether to initiate an investigation.

3. Hire a Top-Rated Securities Fraud Attorney to Help You Report the Fraud

The third option is to hire a securities attorney to help you report the fraud. You can do this at no cost. When you hire a securities fraud attorney, your attorney will review your information and determine where it should be sent. Your legal practitioner can also report the fraud to the SEC or other appropriate agency on your behalf. If you wish to submit a whistleblower complaint to the SEC anonymously, you are required to hire an attorney and include your attorney’s contact information on your TCR form in order to be eligible for a financial award.

If you are a victim of securities fraud, a skilled legal authority may also be able to pursue a claim for financial recovery on your behalf. Federal securities laws give investors the right to pursue fraud claims against companies, brokerage and advisory firms, and individual brokers and advisors. While some claims will need to be filed in federal district court, many claims are eligible for FINRA arbitration.

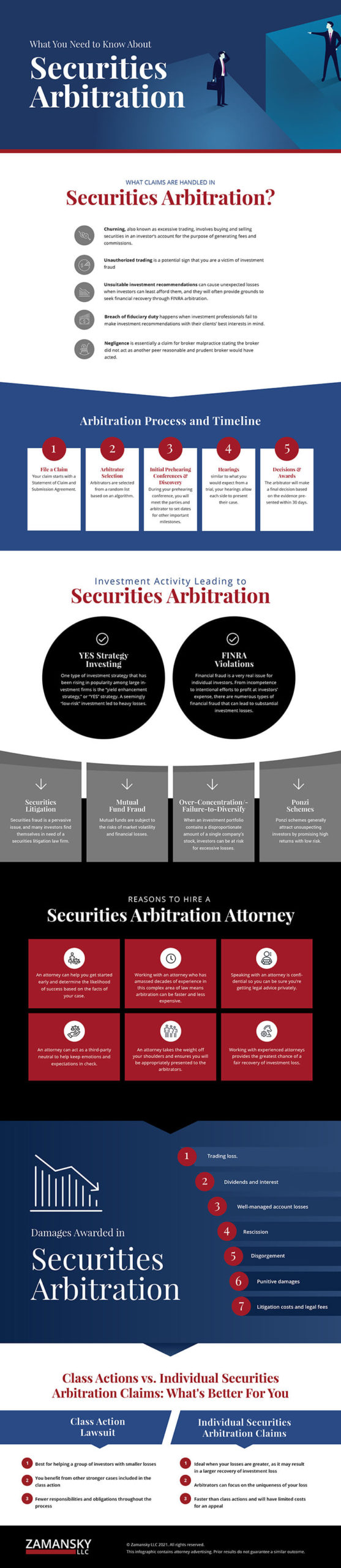

In order to help you decide if you are ready to pursue a claim with an attorney, the infographic below outlines the securities arbitration process:

What Does it Take to Prove Securities Fraud?

Pursuing a successful securities fraud claim in arbitration requires more than just proof of loss. To recover damages for fraud, you must be able to prove that your losses resulted from a broker’s, firm’s or company’s fraudulent misrepresentations or omissions. While your account statements are important evidence, they are just one of many forms of evidence your attorney will need to recover just compensation on your behalf.

When you hire a skilled securities fraud attorney at Zamansky LLC to represent you, they will work with you to collect any other forms of evidence you may have in your possession. These could include prospectuses, emails, other communications, and various other forms of documentation. Your attorney will also examine all relevant public sources of evidence (such as the SEC’s EDGAR database and all pertinent social media profiles), and your lawyer will be able to gather additional evidence through the discovery process in arbitration. Depending on the circumstances, this may include evidence such as:

- Internal memos and communications

- Communications with lenders, funding sources and other third parties

- Draft prospectuses and other draft documents

- Other key internal documents

- Sworn testimony from firm or company representatives

Reporting to the SEC Isn’t Enough

As we discussed above, if you believe you are a victim of securities fraud, one option you have is to report the fraud to the SEC or your state’s securities regulator. But, while this is an option that you have available, it is important to understand that reporting your loss to the SEC isn’t enough to protect your legal rights.

While the SEC will secure restitution for fraud victims in some cases, there is no guarantee that this will happen. The SEC regularly settles fraud allegations, and settlements may or may not include compensation for victims. Additionally, even if the SEC issues a restitution order, there is only a very small chance (at best) that this will result in you receiving the full damages to which you are legally entitled. Finally, any restitution you receive may not come until months, or even years, down the line.

With this in mind, even if you report the fraud to the SEC, you should still hire a securities lawyer to represent you. Your securities fraud attorney can pursue your claim in arbitration, and your lawyer can seek full compensation based on your specific losses. Using the evidence your attorney gathers during the arbitration process, he or she will be able to demonstrate your actual losses from the fraud, and any settlement (which will be subject to your approval) will reflect your best interests under the circumstances at hand.

Speak with a Securities Fraud Attorney in Confidence

Do you have a securities fraud claim against a broker, firm or company? If so, we can use our experience to help you recover your losses in FINRA arbitration. To discuss your claim with a securities fraud attorney at Zamansky LLC in confidence, call 212-742-1414 or request a complimentary consultation online now.